Competitive Grant Reporting

Interim and Final Reports help you to tell us about the successes and challenges you have faced while undertaking important preservation project work. Reporting also helps to ensure the responsible expenditure of Federal funding as well as explain and monitor project completion status. You must submit a report even if you have not drawn down any funding or begun work under your grant.On this page, you will find information on what is required for both interim and final reports. Key forms for these reports are located on the Forms page.

Additional Grant Requirements

You should keep in mind that the terms of your grant agreement may require additional deliverables, draft documentation, or other submissions beyond an interim or final report. Most development (construction) grants, for example, require NPS to review and approve vendor qualifications. You should send these qualifications for review whenever they are ready and not wait until an interim report is due. Equally, deliverables like draft documents, architectural plans and specifications, drawings, or technical reports should be submitted whenever they are ready for review and should not be attached to interim/final reporting.What is Submitted Where?

| Interim Report Final Report |

Submit via GrantSolutions, unless requested otherwise |

| Modification/amendment Request | Submit via email to your grant manager. Note that GrantSolutions does have the technical ability for grantees to directly submit a modification/amendment request within GrantSolutions but this is not a feature used or monitored by our office. |

| Draft deliverables | Check with your grant manager; usually, these items will be submitted via email. |

| Data on subgrants greater than $30,000.00 | Each subgrant greater than or projected to be greater than $30,000.00 must be reported to the Federal Funding Accountability and Transparency Act Subaward Reporting System (FSRS) not later than the month following the month in which the subgrant agreement is signed. Reporting to FSRS is separate from interim or final reporting. |

More information on reporting requirements and getting started in GrantSolutions may be found below.

Interim versus Final Report

|

Interim Report |

Final Report |

|---|---|

|

A complete Interim Report will include:

|

A complete Final Report will include:

|

Time to Submit a Report?

Visit the Forms page to get sample documents and fillable forms.

Getting Started in GrantSolutions

We encourage new grantees to review the frequently asked questions section of the GrantSolutions website to understand how common actions will work in the platform. Common issues, like account creation, user roles, compatible web browsers, and how to receive technical assistance are all discussed. Grantees are responsible for creating, maintaining, and closing user accounts in GrantSolutions. Make sure to review the important details on account role assignment before initiating an account creation request.Grant recipients will mostly use the Grants Management Module (GMM) of GrantSolutions. Additional training and information on common tasks is available from GrantSolutions. These tasks include:

- system navigation

- accepting a grant

- finding your grant

- managing amendments

- submitting reports

- how to log in and configure system roles

- using Grant Notes

Locating NPS Comments on Returned Reports

Many grant recipients are confused about where to access and read comments when a report is returned to them. If a report is returned in GrantSolutions, look for comments under the Status column where blue hyperlinked text (usually reading "Returned") will link to a submission timeline with comments. In this timeline, called the "workflow history", clicking on the carets on the right-hand side of the window will display comments.Interim Reporting

Before Submitting a Report

- Read your grant agreement

- Know your grant number, also called a Federal Award Identification Number (FAIN); you need to include this number in reporting information

- Be familiar with the scope of work and deliverables under your grant agreement

In addition, unless otherwise specified in your grant agreement, all interim reports and the final report must be submitted with the appropriate SF-428 Tangible Personal Property Report only if equipment has been purchased using grant funds.

A complete interim report will include at least:

- Interim Reporting Worksheet — in GrantSolutions, you may upload and attach this to the PPR or FFR

- SF-425 Federal Financial Report — you may directly complete and submit this form within GrantSolutions, where it is referred to as the FFR

- Drawdown history from the ASAP payment system — in GrantSolutions, you may upload and attach this to the PPR or FFR

- appropriate version of the SF-428 Tangible Personal Property Report (if required) — in GrantSolutions, you may upload and attach this to the PPR or FFR

Submitting the Interim Report

The interim report should be submitted in GrantSolutions following the terms of your grant agreement.

Final Reporting, Closeout, and Record Retention

Before Submitting a Report

- Read your grant agreement

- Know your grant number, also called a Federal Award Identification Number (FAIN); you need to include this number in reporting information

- Be familiar with the scope of work and deliverables under your grant agreement

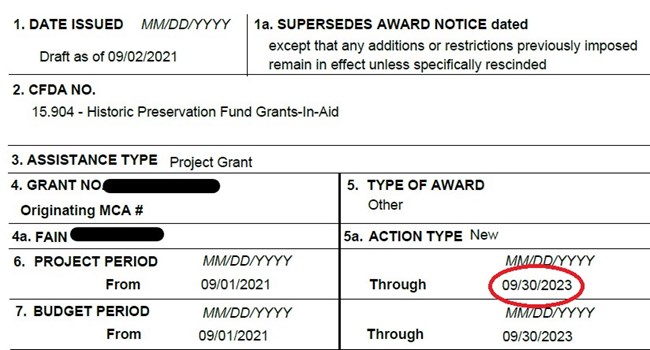

Final reports may be submitted at any time when you are ready to close your grant. No new costs may be incurred after the end date of your grant identified in block 6 of the notice of award; however, you have up to 120 days after that date to make final drawdowns and to prepare and submit final reporting to the National Park Service. All reports must be accompanied by the SF-425 Federal Financial Report as well as a printed history from ASAP of reimbursements made through the end of the grant.

The final report must be submitted with the appropriate SF-428 Tangible Personal Property Report only if equipment has been purchased using grant funds.

A complete final report will include at least:

- Final Reporting Worksheet — in GrantSolutions, you may upload and attach this to the PPR or FFR

- SF-425 Federal Financial Report — you may directly complete and submit this form within GrantSolutions, where it is referred to as the FFR

- Drawdown history from the ASAP payment system — in GrantSolutions, you may upload and attach this to the PPR or FFR

- appropriate version of the SF-428 Tangible Personal Property Report (if required) — in GrantSolutions, you may upload and attach this to the PPR or FFR

Submitting the Final Report

The final report should be submitted in GrantSolutions following the terms of your grant agreement.

Record Retention

You should make sure to comply with federal record retention requirements as you prepare to closeout your grant award.

Last updated: July 23, 2024