News Release

You are viewing ARCHIVED content published online before January 20, 2025.

Please note that this content is NOT UPDATED, and links may not work. For current information,

visit https://www.nps.gov/aboutus/news/index.htm.

This annual report is produced jointly by NPS and CUPR.

News Release Date: February 27, 2024

Contact: NewsMedia@nps.gov

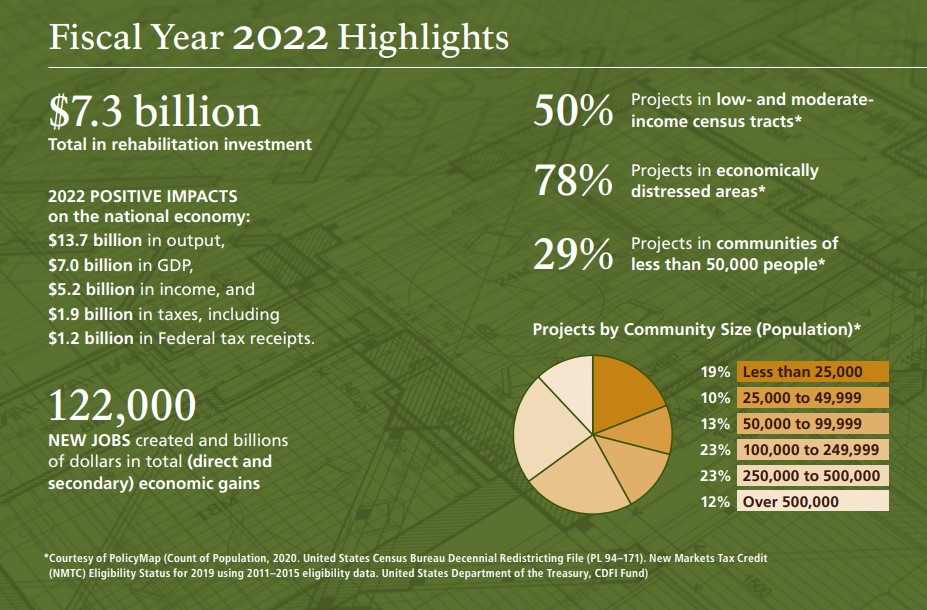

WASHINGTON – The National Park Service certified historic rehabilitation projects in fiscal year 2022 totaling $7.3 billion of private investments as part of the Federal Historic Preservation Tax Incentives Program, contributing more than $13.7 billion of output in goods and services to the United States economy, generating approximately 122,000 jobs, and adding an overall $7 billion in gross domestic product (GDP).The impacts are highlighted in the Annual Report on the Economic Impact of the Federal Historic Tax Credits for Fiscal Year 2022, which was produced by the Rutgers University’s Center for Urban Policy Research through a cooperative agreement with NPS. The economic impact report includes state-by-state data and several case studies.

Since its inception in 1976, the tax incentives program, commonly known as the Historic Tax Credit, has leveraged $235 billion in private investment to rehabilitate over 48,000 historic properties, producing more than 3.2 million jobs, $503.8 billion in output, and $251.6 billion in GDP.

“Private investments in historic preservation are helping to revive abandoned or underutilized buildings into affordable housing, offices, creative spaces, community athletic centers, and more,” said National Park Service Director Chuck Sams. “These projects promote community revitalization in our nation’s cities and towns, along main streets and in rural areas, boosting the economy and creating thousands of jobs.”

The tax incentives program provides a 20 percent federal tax credit to property owners who undertake a substantial rehabilitation of a historic building in a commercial or other income-producing use while maintaining its historic character.

A common misconception about the program is that it only supports large projects and projects in large cities. According to this year’s report:

- Half of the certified rehabilitation projects were in low- and moderate-income areas.

- More than three-quarters (78 percent) of all projects were in economically distressed areas.

- Nearly a third (29 percent) of the projects certified were in communities of less than 50,000 people.

The program is administered by NPS and Internal Revenue Service, in partnership with State Historic Preservation Offices. NPS’ role is to certify that a building is historic, eligible for the program, and that the rehabilitation preserves the building’s historic character. The IRS is responsible for administering the other aspects of the tax credit under the Internal Revenue Code.

The tax credit program’s 2022 annual report and 2023 annual report are also online. These reports include program statistics and examples of the many different types of buildings and rehabilitation projects across the nation that were certified by NPS in fiscal years 2022 and 2023.

State Historic Preservation Offices are the first point of contact for information and guidance for property owners interested in the program, and NPS works closely with them in the administration of the program.

Fiscal Year 2022 Highlights

Economic Benefit

- Program-related investments generated $2.3 billion in construction and $2.0 billion in manufacturing. (As a result of both direct and multiplier effects, and due to the interconnectedness of the national economy, sectors not immediately associated with historic rehabilitation, such as agriculture, mining, transportation, and public utilities, benefited as well.)

- Total estimated rehabilitation investment (Qualified Rehabilitation Expenditures): $6.5 billion

- Historic rehabilitation projects certified: 858

- Estimated total jobs created: 122,000 (43,000 jobs in construction and 27,000 jobs in manufacturing)

- Output (Goods and Services): $13.7 billion

- Gross domestic product: $7.0 billion

- Income created: $5.2 billion

Rehabilitation in Action

PROJECT PROFILE

Historic Name: Open Air School

Current Name: Open Air Columbus

Year Built: 1928

Rehabilitation Completed: 2022

Original Use: School

New Use: Local small businesses, including café and restaurant

Estimated Qualified Rehabilitation Expenditures: $5,003,100

Estimated Total Project Cost: $6,588,100

Perched on a wooded hill above the Olentangy River, the Open Air School is perfectly positioned for its historic use—an open-air school—and it seems particularly fitting that the rehabilitation of the school took place during the recent pandemic, when people gravitated outdoors to spend time together. Read more about the project.

About the National Park Service. More than 20,000 National Park Service employees care for America's 429 national parks and sites and work with communities across the nation to help preserve local history and create close-to-home recreational opportunities. Learn more at www.nps.gov and on Facebook, Instagram, Twitter, and YouTube.

Last updated: February 28, 2024